Dive Brief:

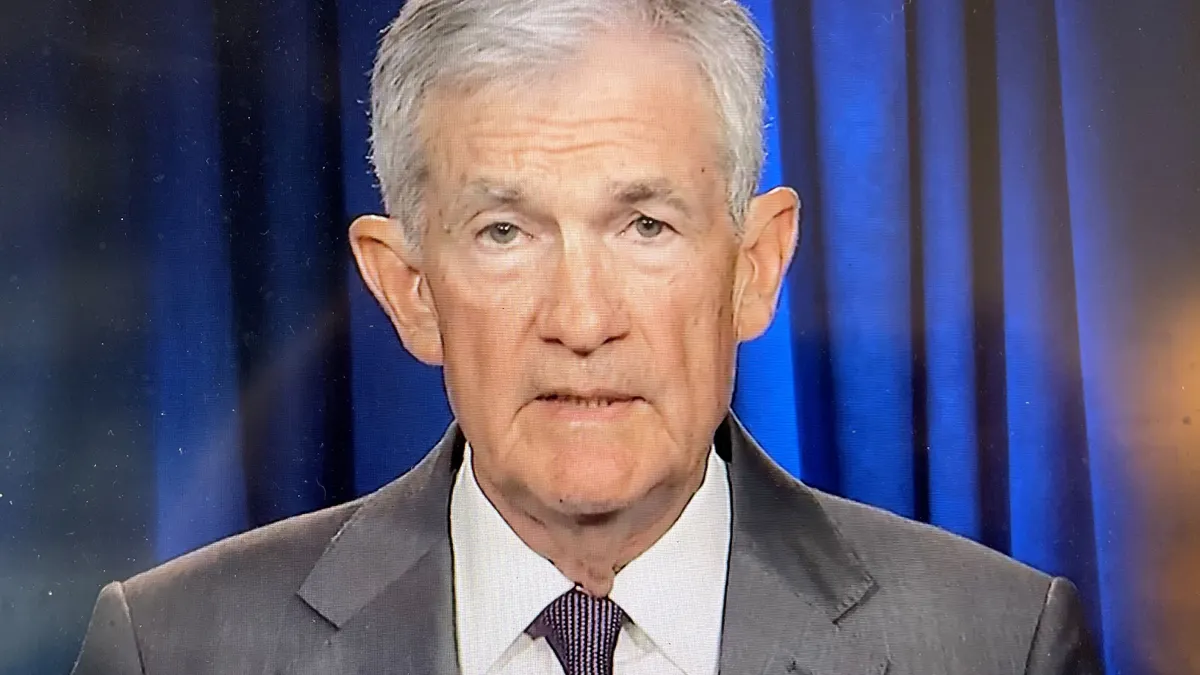

- The U.S. Department of Justice is conducting a criminal investigation into Federal Reserve Chairman Jerome Powell over testimony he gave last year about renovations to the central bank’s headquarters, the Fed said on Friday.

- The central bank says it has received grand jury subpoenas threatening Powell with possible indictment for his remarks before the Senate Banking Committee in June 2025, when he was asked about cost overruns and approvals by reviewing bodies for the project, which is projected to cost some $2.6 billion.

- In a video response posted to the Fed’s website, Powell called the cost overruns and his testimony a pretext to pressure the central bank to lower interest rates. “This unprecedented action should be seen in the broader context of the administration's threats and ongoing pressure,” Powell said.

Dive Insight:

President Trump raised the possibility of firing Powell last year after the two met to tour the renovation work being done to the Fed headquarters, the Marriner S. Eccles Federal Reserve Board Building.

Trump told reporters at the time he wasn’t planning to fire Powell but that he wouldn’t rule it out. "He's a terrible Fed chair,” he said. “I was surprised he was appointed.” Trump nominated Powell as chair in 2017, during his first term of office.

In his testimony last year, Powell said the renovations, which were initially estimated to cost $1.9 billion, increased in price 35% after the agency made changes based on requests by the U.S. Commission of Fine Arts. The CFA shares jurisdiction with the National Capital Planning Commission over architectural work undertaken in the National Mall area of Washington, D.C., where the Federal Reserve headquarters is located.

According to Powell and budget information provided by the Fed, after the Arts Commission asked it to drop plans for a five-story tower addition, it added below-ground space at a higher cost. Also, once construction began, the general contractor came across unexpected asbestos in the building, toxic soil contamination and a higher-than-expected water table.

The project also faced significant increases in the cost of steel, cement, wood and other materials. And there was a costly disruption when the agency fired the original architectural and engineering firm it had hired to work on one of the buildings after the Fed’s inspector general called out the firm’s performance.

“This new threat is not about my testimony last June or about the renovation of the Federal Reserve buildings,” Powell said in his statement. “It is not about Congress's oversight role; the Fed, through testimony and other public disclosures, made every effort to keep Congress informed about the renovation project. Those are pretexts.”

A ruling last year by the Supreme Court on a case involving another agency alluded to the independent status of the Federal Reserve and indicated the president can fire a Fed board member only for cause, meaning either malfeasance in office or incompetence, not for policy differences.

Critics say the administration’s attacks on the Fed’s independence threaten the stability of the dollar and the United States as a safe haven for global investment.

Sen. Thom Tillis, R-N.C., a member of the Senate Banking Committee who would vote on anyone the White House nominates to replace Powell, criticized the investigation and said he won’t back any nominee for Fed chair if the probe is still ongoing when a vote comes up. Powell’s term as Fed chairman ends in May, though he could remain on the Board of Governors until January 2028. Trump is widely expected to nominate Kevin Hassett, his top economic adviser, to be Fed chair.

“If there were any remaining doubt whether advisers within the Trump administration are actively pushing to end the independence of the Federal Reserve, there should now be none,” Tillis said. “It is now the independence and credibility of the Justice Department that are in question.”