Dive Brief:

- An investment of $26,000 for a monitoring system can save hundreds of thousands of dollars in battery replacement and maintenance costs over 15 years, according to an analysis by a company that manufactures a battery monitoring system.

- The savings come in two ways, according to Franklin Electric Grid Solutions. The first is using batteries for as long as they’re good rather than replacing them on a fixed schedule. The second is eliminating the need for annual third-party maintenance checks, the company says in its analysis.

- “Battery monitoring systems [deliver] real-time insights into battery health, extending service life and optimizing replacement cycles,” says the company.

Dive Insight:

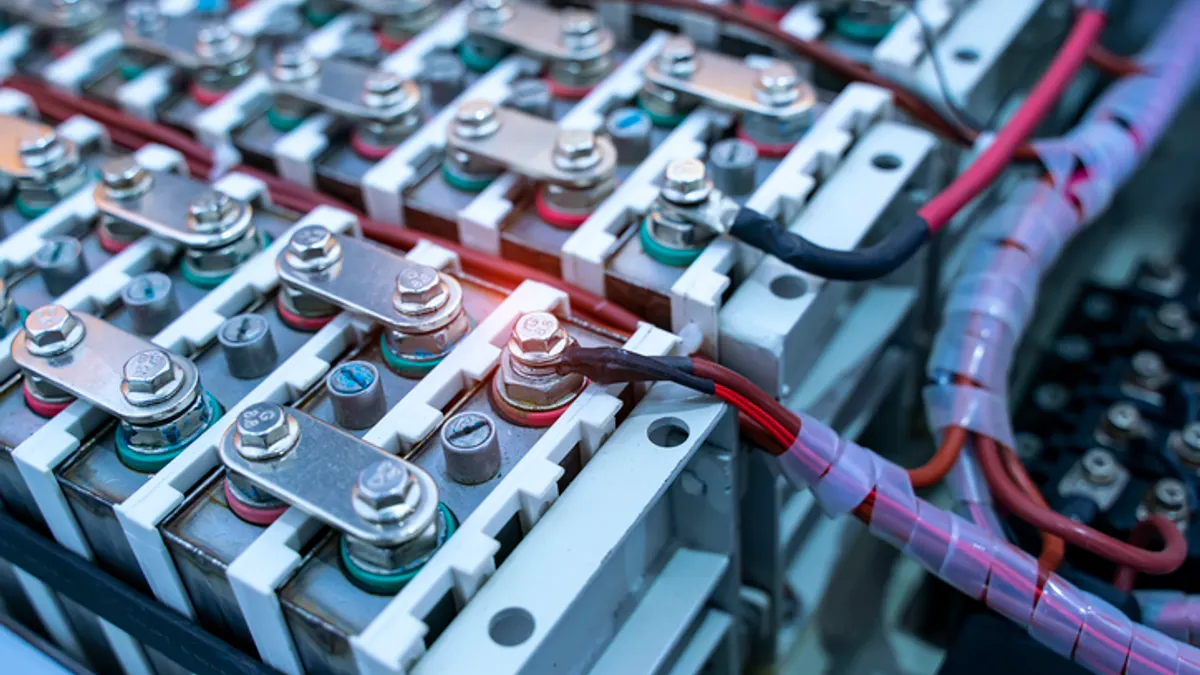

Battery systems are common in hospitals, data centers, telecommunication hubs and other facilities, where backup power is essential. A facility manager using batteries to generate 1 megawatt of uninterruptable power might install six battery strings of 44 batteries each, with each battery containing a 700 watt power per cell, according to the analysis.

A system of that size would cost around $132,000, assuming a total of 264 batteries at a cost of $500 each.

It’s typical for facilities that maintain a system of this kind to put the batteries on a 5-year replacement schedule and have a third-party specialist provide regular maintenance checks. When the maintenance contract is added to the replacement cost of the batteries, the 1MW system can cost the facility about $16,000 a year, the analysis estimates. Over 15 years, assuming battery replacement every five years, the system can end up costing the facility more than $500,000, the company says.

This replacement approach leads to costs higher than they have to be, the company says, because probably a third of the batteries that are replaced still have years of service in them.

“Entire battery strings are replaced on a fixed schedule, often every five years, without assessing the true condition of each battery,” the analysis says.

Even if the maintenance contractor conducts what are called Ohmic value tests on the batteries to see if replacement is needed, these tests are unlikely to give an accurate picture of the batteries’ remaining useful life, the company says.

Annual, semi-annual and quarterly Ohmic tests may not always provide reliable data, especially when they’re not compared to baseline measurements, the company says. “This periodic approach to standard testing may not offer a complete view of battery health,” it says.

A better way to monitor battery health, the company says, is to attach a sensor to each battery for continuous monitoring. That eliminates the need for the annual maintenance contract and also enables facilities managers to know when a battery needs replacement.

“The actual time a battery remains functional in real-world conditions … varies based on usage, environment, and maintenance and may differ from the design life,” it said.

For example, if the system is set up so the depth of discharge for each battery stays under 10%, the useful life of the battery will tend to get extended.

Depth of discharge refers to the amount of power in the battery that’s used before recharging. “Batteries can exceed their designed cycle life when DoD remains below 10%,” Franklin Electric Grid Solutions said.

If an operator was able to keep batteries in service for their entire useful life, the facility could reduce the estimated cost by a third, to $92,000, the company says.

The system’s total cost over 15 years would shrink from more than $500,000 to a little more than $300,000, it says. That’s based on the longer use of the batteries and not having to pay the annual maintenance contract, while accounting for the $24,760 needed to implement the building management and monitoring system..

“The BMS pays for itself in under two years through cost reductions alone,” the company said.

Facilities managers that want to keep the maintenance contract for compliance or other purposes, even if they do the battery monitoring, can still realize the bulk of the savings, the company says.

The “maintenance contract … cost would be negligible compared to the overall savings and would have little impact on the long-term ROI,” it says.