Facilities managers will continue to switch from fossil fuel-powered heating and cooling systems to heat pumps and to integrate electric vehicle, renewable energy generation and microgrid technologies into their buildings in 2026 to reduce energy consumption and greenhouse gas emissions and increase their buildings’ resiliency, according to experts in building systems.

“Electrification is here to stay, and that's been across the board,” Jennifer Nuckles, CEO of smart building platform R-Zero, said in an interview.

Electrification, the process of converting energy-consuming devices and systems from fossil fuels to electricity, is an emerging economy-wide decarbonization strategy, according to the U.S. Department of Energy.

“Electrification is at the heart of carbon neutrality,” DOE says in a fact sheet. “If electricity can be generated using clean, renewable energy sources such as wind and solar — even with fossil fuels in the generation mix — switching to EVs and other electrification technologies can lower overall emissions.”

Tyler Haak, vice president of sustainability and service at Schneider Electric, says there’s a confluence of events leading to building electrification, including states’ tightening emissions regulations and advances that give building operators options for achieving performance goals, like “the integration of distributed energy resources such as rooftop solar and battery storage,” he said.

Public incentives are also helping, with many states offering benefits to building owners for electrification. “Supported by state policies, a rising share of new ... commercial customers across all states [are adopting] electric space- and water-heating rather than natural gas,” the American Clean Power Association said in May. An example is California, which last year released a plan to rapidly scale heat pump adoption to help achieve a long-term goal of installing 6 million electric heat pumps by 2030.

Many localities are offering their own incentives. Columbia, Missouri, for example, is offering companies rebates of up to $7,450 for switching to an electric HVAC system, and the District of Columbia is offering a range of rebates for switching. Many utilities are offering their own programs as well.

Economics are also a driver, with the U.S. facing record energy demand and prices that have only been going up. By some estimates, transitioning gas-fired or electric resistance rooftop units to higher-efficiency air-source heat pumps could reduce average energy consumption by 10% and greenhouse gas emissions by 9% across all commercial real estate sectors, according to the National Laboratory of the Rockies, formerly known as the National Renewable Energy Lab. NLR found even greater energy savings when buildings were transitioning away from natural gas (17%) and fuel oil or propane units (50%).

Savings of that magnitude could propel building operators to stick to their transition plans even as electrification and renewable energy foes succeed in clipping state and local efforts to push electrification. Among other things, fossil-fuel backers have been using lawsuits — and legislation in Congress — to try to prohibit states and localities from enforcing one of their main strategies for encouraging building operators to make the switch: gas-ban laws. The back-and-forth over these bans could come to a head this year.

Electrification efforts face other barriers, however. “The industry faces a shrinking skilled labor pool, making implementation of strategy difficult,” Haak said. “Complex regulatory landscapes can slow adoption, but advanced automation and unified data platforms are helping organizations overcome these barriers.”

Federal barriers could increase costs, complexity

The Trump administration and Congress have created significant headwinds at the federal level with the One Big Beautiful Bill Act. The law ends tax benefits for some heat pumps, solar and wind technologies and energy efficient improvements in commercial buildings, but it carves out protections for geothermal and storage systems, according to tax consulting firm RSM. For example, the 179D tax deduction for energy efficiency improvements to commercial property expires June 30, 2026, and the 48E clean electricity investment tax credit phases out wind and solar credits for facilities not placed in service by the end of 2027, according to a paper by Ruben Abreu, director and energy efficiency engineer at tax law firm Ryan. Abreu serves as president of the ASHRAE Miami Chapter and is a subject matter expert for ASHRAE’s Government Affairs Outreach in Region XII.

“Federal programs come and go, but the ... business is saving energy, because energy is costing more and we can do things more efficiently."

Patrick Towbin

Chief of Engineering and Construction at Ecosave

Building owners and operators should be aware of applicable safe harbor dates and federal guidance, such as recommendations that those seeking 179D tax deductions incur 7% of the total estimated construction cost threshold to meet beginning construction targets by June 30, Abreu wrote.

Section 179D is among those tax provisions that “are widely expected to be included in the next Congressional Tax Extenders Package, as has been the case in previous years,” Abreu said in the paper. “However, the temporary and uncertain nature of these extensions makes it difficult to plan for these incentives in advance. Despite this, supporting these provisions is highly beneficial to the industry, particularly for developers, building owners, architects and engineers who rely on them to support energy-efficient construction and design.”

Construction on commercial solar assets must begin by July 4 to preserve federal solar tax credits beyond 2027. Those that do not meet this begin-construction deadline generally must be placed in service by Dec. 31, 2027, according to Southern Energy Management, a solar power and building performance firm.

Although OBBBA is disrupting 179D tax deductions, it does specifically carve out protections for credits for geothermal heat pumps, which may begin through 2034, and other electricity-generating facilities with a greenhouse gas emissions rate not greater than zero, according to tax and consulting firm RSM.

The DOE has also been working to pull back funding for electrification and clean energy projects, and it has rescinded its national definition of a zero-emissions building while discouraging states, municipalities and standards-setting bodies from using or referencing the definition. On Jan. 22, DOE said it was in the process of revising or canceling more than $83 billion in loans for clean energy technologies that had been approved under the Biden administration.

Despite these efforts, building operators are likely too invested in the benefits of electrification to change course, Nuckles said. “Stakeholders are becoming smarter about [the shift to electric],” she said.

State and local impacts on electrification

With the pullback on federal support for net-zero buildings and the Trump administration’s tightening or elimination of federal tax incentives, what’s happening on the state and local levels to drive or impede electrification?

Dozens of cities have gas appliance bans in place, most often restricting their use in new construction or restricting gas lines being extended to new developments. Several California communities have rescinded their bans, however. Berkeley, California — which enacted the country’s first gas ban in 2019 — agreed to end its program after losing a court battle and entering into a settlement agreement. The court found its regulation violated the Constitution’s supremacy clause by putting in rules that go against the federal Energy Policy and Conservation Act, which gives deference to certain types of energy products, including gas appliances, that DOE approves. The Trump administration also recently sued two California cities over their gas bans, even though both report they have not enforced the bans since the Berkeley court decision.

Some states are codifying “consumer choice” with laws that preempt local gas bans. More jurisdictions would be forced to rescind their bans if legislation in Congress, sponsored by Rep. Nick Langworthy, R-N.Y., passes. It would end gas-appliance bans outright by preventing states and localities from singling out gas in the types of energy connections they allow.

With the future of gas bans uncertain, cities will likely use other regulations and incentives to keep the electrification push going, experts say. In New York, for example, building owners must meet greenhouse gas emission limits and energy thresholds in the All-Electric Buildings Law, passed in July. The law requires most new buildings and commercial buildings over 100,000 square feet in New York to use electric heat and appliances. That law was scheduled to take effect this month, but Gov. Kathy Hochul has paused it temporarily.

Electrification options

Building operators have numerous options for electrification, according to Craig Walter, principal energy advisor at Engie Impact, a firm that partners with organizations to accelerate building decarbonization efforts.

It’s a more complex decision for some types of businesses that traditionally rely on fossil fuels, Walter said in an interview. A restaurant might consider gas important to product quality, or a manufacturing facility might need especially high temperatures for operating processes, for example.

But no hurdle should be too high, even in heavy industrial situations, Ian Shapiro, professor of practice of mechanical and aerospace engineering at Syracuse University, said in an interview. Due to advancements like variable refrigerant flow, made possible in part by the DOE’s Commercial Building HVAC Technology Challenge, virtually any building can electrify heating and cooling systems with heat pumps, he said.

“Facilities [can] move away from fossil fuels without sacrificing performance.”

Ned Greene

Associate Principal at PAE Engineers

Shapiro pointed to New York, where temperatures can get extremely cold, as an example of how heat pumps can work even under extreme conditions. He estimated there are more than 100,000 heat pumps in use in the state, and more growth of heat pump use in the region is expected as fossil-fuel powered energy becomes more expensive, according to a Syracuse University report.

Adoption of geothermal heat pump technology in particular is expected to rise due to its continuing favorable treatment in OBBBA, Keith Martin, attorney at law firm Norton Rose Fulbright, told Canary Media. Building operators can still claim tax credits for geothermal heat pump projects that start as late as 2034, he said.

Geothermal heat pump use is already well underway across facilities like hospitals and airports that are in some of the most energy-intensive industries, according to Ned Greene, associate principal at PAE Engineers, demonstrating that this approach is both operationally feasible and economically sound, he wrote in a piece for Facilities Dive.

For example, a groundwater heat pump set to begin operations this year at Portland International Airport will provide 90% fossil fuel-free heating, resulting in high-efficiency thermal comfort and minimal carbon output, Greene said. Hospitals, meanwhile, can use heat pumps to recover and reuse energy from heat used in the sterilization processes, IT cooling and food preparation, he said.

“Heat pumps offer a route to electrification, enabling facilities to move away from fossil fuels without sacrificing performance,” he said.

High up-front costs for heat pumps continue to be a barrier to adoption, however, especially in regions with low-cost natural gas or high electricity rates, according to a report on beneficial electrification released by The Brattle Group in November.

Energy storage

With increasing electricity prices, facility managers might be concerned that electrification will result in higher heating costs in the short term compared with natural gas-powered heating, despite other energy efficiency measures they undertake. One strategy to cushion costs is pairing electrification with on-site renewable energy and storage, demand response and smart controls to shift load to off-peak hours.

OBBBA largely protected tax credits for battery storage systems, although they will be subject to more stringent rules on foreign sourcing. Foreign entity of concern provisions also establish strict limitations on participation in federally supported programs and safe harbor dates that could significantly impact efforts to reduce energy consumption and decarbonization projects, Abreu said in the paper.

In energy-intensive sectors like manufacturing, operators are working to implement thermal energy storage. TES systems contain a medium that can store cold or heat, such as that generated from industrial processes, from excess renewable energy or from traditional energy sources at off-peak times and rates. They then discharge it to heat or cool a building or for other uses, providing the power at a much lower cost.

“By drawing power when it is cheapest and least valuable to the grid and storing it for very long durations, they cut costs and stabilize supply,” Katherine Hamilton and Isaac Brown, interim executive director and incoming executive director of the Thermal Battery Alliance, wrote in Utility Dive in December. “For manufacturers, thermal batteries are a drop-in solution that unlock abundant, low-cost energy, boosting competitiveness and securing long-term energy supply.”

Existing thermal battery technologies store energy at temperatures high enough to address 99% of U.S. industrial heat demand using clean, surplus power, the alliance says, citing data from NLR.

Efficiency and demand response

Flexible behind-the-meter technologies, which lean on electrification and energy storage capacity to control and respond to real-time grid signals to help optimize grid operations, have increased substantially in the past decade, according to the Brattle Group report.

Operators can implement energy management control technologies to make electrification more economically feasible and possible with the current workforce, according to a whitepaper released in November by HVAC optimization company Parity. Electric utilities' demand response programs are also providing incentive for building operators to pair electrification with energy-saving retrofits, it said.

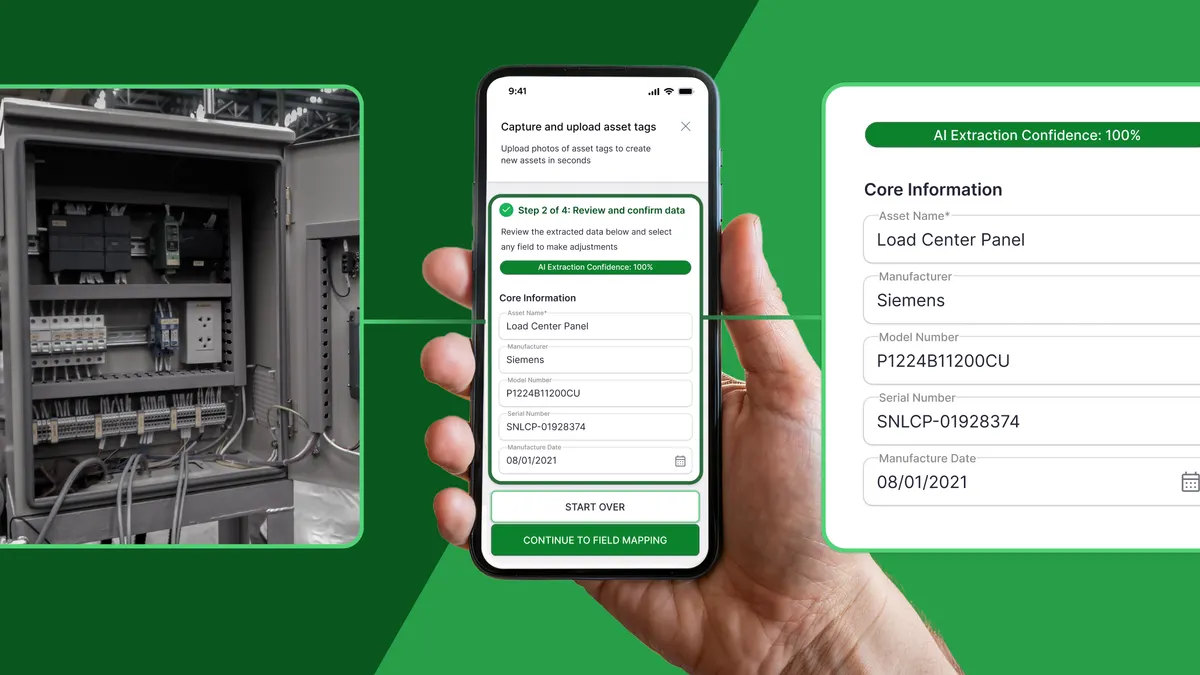

“The convergence of AI-driven platforms and predictive analytics allows buildings to self-diagnose inefficiencies and correct them in real time, reducing energy consumption and extending asset life,” Schneider Electric’s Haak said. “These frameworks empower less experienced technicians and make advanced energy management more accessible and cost-effective.”

Building control and energy management automation also allows owners to take full advantage of the benefits of utility DER programs, especially as utilities move toward more sophisticated programs like virtual power plants, the Parity white paper says.

In 2026, building electrification will be shaped by how seamlessly systems work together, according to Haak. “AI-driven platforms will optimize energy use in real time, while buildings become active producers and managers of power through integrated DERs,” he said. “Automation will shift from simple control to orchestrating outcomes, making buildings smarter and more efficient. Industrial facilities will lead this innovation, turning efficiency into a competitive edge.”

In offices, operators can now pair occupancy data with building automation and energy management systems to predict peak pricing and shape occupancy and energy use around it, according to Nuckles.

Timing and cost

The decision to electrify is really about planning for the future, Engie Impact’s Walter said. While a building owner probably won’t go out and invest in replacing a five-year-old gas unit with a heat pump, it’s important to make sure that electrification is on the horizon for when that unit is replaced. Operators should have a game plan to ensure that a building has the infrastructure in place to electrify, he said.

Without federal incentives, many organizations are looking to energy savings performance contracts and energy-as-a-service agreements to combine financing with energy conservation measures, renewable energy infrastructure and smart building controls to convert large capital costs into fixed operating expenses.

“Federal programs come and go, but the core of our business is saving energy, because energy is costing more and we can do things more efficiently,” Patrick Towbin, chief of engineering and construction at Ecosave, an energy service company, said in an interview. “There is a short-term view that the administration we have now has taken out some of the incentives, but they’ve definitively given a guaranteed runway of two years, which has actually increased the speed of a lot of these projects to actually close.”

“Strategic consultation” with tax professionals and professional engineers “can help uncover hidden value, mitigate risks and align financial planning with evolving compliance requirements,” Abreu said in his paper. “In this rapidly changing environment, the difference between missed opportunities and optimized outcomes may rest on choosing the right expertise.”