CBRE’s revenue jumped 16% year over year in the second quarter, with occupiers largely proceeding to execute growth and other plans despite uncertainty in the overall economy, CEO Bob Sulentic said in the company’s earnings release.

The real estate service firm’s resilient businesses, including facilities management, project management, property management and other portfolio services, grew 17% year over year to $8.1 billion.

“Resilient revenue growing faster than transactional revenue during a market recovery attests to the progress we’ve made with our resilient businesses,” Sulentic said in a statement. “We are especially focused on our two new segments — building operations and experience and project management — and are pleased with the progress they're making.”

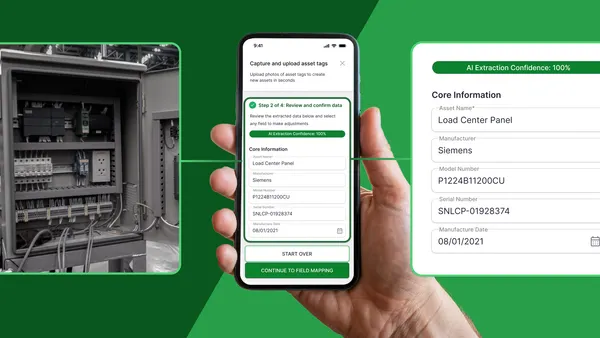

CBRE established its Building Operations & Experience segment in January after acquiring full ownership of co-working company Industrious and integrating the project management capabilities of Turner & Townsend, which CBRE has held a majority stake in since 2021.

Within the segment, facilities management revenue increased 17% year over year, driven by strong growth across the firm’s enterprise and local businesses. Enterprise growth was led by data center hyperscalers and the technology, healthcare and industrial sectors and “supported by a balanced mix of new client wins and expansions, CBRE said in its earnings presentation.

Property management revenue rose 30% year over year, with contributions from Industrious enhancing the growth rate, according to CBRE. In March, the company appointed company veterans to lead the segment’s Americas property management business, including Kristi Rankin — former managing director for the firm’s property management business in Chicago — who was promoted to head of the U.S. property management operations.

CBRE’s U.S. leasing revenue grew 14% year over year, led by office and industrial sectors, according to the company’s earnings report.

“The leasing business is going quite well now for office buildings,” Sulentic said. ”The momentum is expanding from Park Avenue type locations in the gateway cities to a broader swath of the gateway cities, and now in a very big way, in the second tier markets and smaller markets below that.”

This momentum is being driven by an element of a “return to the mean” due to COVID being so far in the rear view mirror, and U.S. corporate clients being “serious about using office space to get their employees connected, more produced, [and] more excited about the companies they work for,” Sulentic said. “That’s been a big plus for us in that business. You have all those things going on, [so] we expect office building leasing to continue to be strong. One of the things that’s going to create is some challenges with the lack of supply in certain areas.”

The company’s new project management segment grew revenue 13% year over year, with the integration of Turner & Townsend “progressing well,” Sulentic said on an earnings call. The CBRE legacy project management business saw low-double-digit growth led by the financial and energy sectors, he said.

“This is notable given a slowdown in capital projects from some clients who are most impacted by the uncertain economic environment in the real estate investments segment,” CBRE Chief Financial Officer Emma Giamartino said on the call. The project management segment now includes about 15,000 professionals, which CBRE “can now move … into areas in a way that we couldn’t move them before,” Sulentic noted.