Dive Brief:

- Property operations platform Visitt has secured more than $20 million in funding to expand its interface and introduce new AI agents, the company announced Monday.

- The $22 million series B follows a year of rapid expansion for the company, which last year surpassed 150 customers and grew the amount of square footage its software manages by 900%, Visitt said. The funding will be used to bolster the company’s platform by introducing agents intended to help operators save time on manual work, build more predictive intelligence and scale customer experience teams, the company says.

- “This investment allows us to accelerate innovation while staying true to how we operate: as true partners with our customers,” Visitt co-founder and CEO Itay Oren, said in a statement.

Dive Insight:

Visitt’s AI-native technology is designed to combine into a single platform disconnected commercial real estate systems, including systems for work orders, compliance, predictive maintenance, tenant communications, equipment lifespan tracking, security, amenities and finance, the company says.

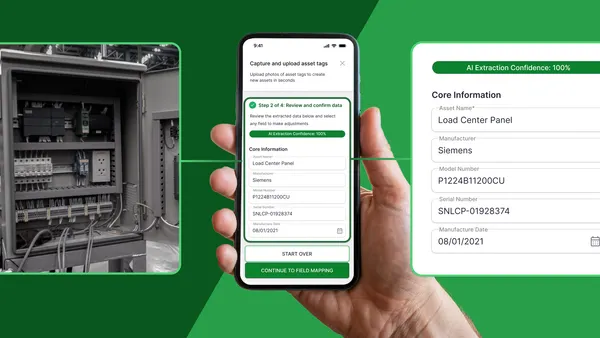

In 2025, it launched an AI agent to help operators automate the management of certificates of insurance, or COIs, without requiring manual input from facility staff.

Visitt says it’s working to deliver a team of fully automated agents that can provide “real, end-to-end automation,” co-founder Jonathan Kroll told Facilities Dive in August. The goal is to reduce the “administrative load” on facilities teams so they can “focus on what really matters — running their buildings efficiently and serving tenants better.”

Data that the company collects, along with the feedback it gets from customers, is going into the development of the preventative maintenance and equipment lifecycle management agents it’s building, Kroll said.

“There is a lot of data that is being recorded in the platform from all the day-to-day activities — inspections or notes that are added, photos that are being taken,” he said in an interview. “All of this data is very valuable in order to be able to determine the health and condition of a certain asset. [By surfacing] this data to technicians or engineers [we can] help them determine specific asset or equipment condition.”

That kind of information will help facility managers better understand the condition of assets and can inform maintenance and replacement decisions, he said.

“We see a lot of value in these very straightforward use cases where AI can already take care of review and verification processes,” Kroll said. “We see that we can save a lot of time, but also help property management companies ensure that they’re capturing revenue.”

The investment was led by Susquehanna Growth Equity with participation from existing investors Vertex Ventures Israel, Anfield and Sarona Ventures, according to the company.