Schneider’s Energy Management segment continues to ride the data center boom, reporting 10% year over year growth in the third quarter, including a 17% jump in North America, where the big tech companies known as hyperscalers could spend close to $200 billion on data center-related investments this year.

“Our pipeline and order trends remain strong, particularly in North America and China, with continued high demand from hyperscalers and strong and accelerating demand from new AI-related players,” Schneider Electric Chief Financial Officer Hilary Maxson said on Thursday on the company’s earnings call.

Across all its businesses, the Paris-based electrical equipment company grew 9% organically to 10 billion euros, or about $11.5 billion.

"We delivered another strong quarter … across all four of our end-markets,” CEO Olivier Blum said in a statement. “Energy Management led the growth, where sustained Data Center demand drove performance.”

The performance comes as Schneider expands its product and service portfolio to accommodate large-scale data centers’ needs.

Last year, the company said it would purchase a 75% stake in Motivair, strengthening its presence in the fast-growing market for high-performance cooling systems. In September, Schneider said it had co-developed two data center reference designs with NVIDIA that integrated cooling, power management and other systems. Schneider and NVIDIA said the designs could significantly reduce data center deployment headways.

Growth from nonresidential building segments

Schneider’s Energy Management Group benefited from strong demand from other nonresidential building owners as well, the company said.

Demand from residential buildings was soft, with noticeable weakness in China and North America. But Maxson emphasized that residential is a relatively small part of the company’s buildings business. Customer demand from “technical buildings like retail and hotels” supports an overall positive trajectory for this part of Schneider’s business, she said.

Maxson previewed a shift in Schneider’s market positioning that she said company leaders would discuss in more detail at its Capital Markets Day on Dec. 11. The new emphasis on Schneider’s status as an “energy technology partner” across industries looking to electrify, automate and digitize is “not a revolution” but rather a conviction that “we’re the player that has the real opportunity to be the winner in that space and define it,” she said.

Brisk uptake for software solutions

Schneider’s holistic focus on energy management solutions for complex commercial and industrial facilities drove solid gains in its software vertical, which grew 8% and accounted for 19% of total group revenues in the quarter.

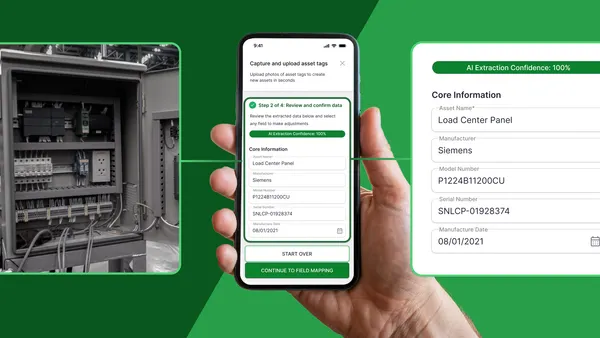

Schneider acquired the platform-agnostic software provider AVEVA in 2023 to support its EcoStruxure energy management and automation solutions. In the third quarter, AVEVA reported 12% recurring revenue growth thanks to strong uptake from Schneider customers, the company said.

EcoStruxure also grew briskly along with Schneider’s cybersecurity offerings.

Adjusting to tariff and supply chain challenges

Maxson said Schneider was making progress on what the quarterly presentation described as “commercial and supply chain actions to counter the impacts of tariffs” but indicated the company wouldn’t fully offset tariff and inflation impacts with higher pricing in 2025.

“We would expect to make that [up] over the next few quarters,” she said.

In its quarterly presentation, Schneider singled out Mexico as a weak spot in the North American market due to the “ongoing macroeconomic environment.” Maxson reiterated this on Thursday’s earnings call, adding that those macroeconomic issues related to “tariff uncertainties.”

On a positive note, Maxson said Schneider’s top 1,000 suppliers have reduced their operational carbon emissions by 53% since 2020, meaning the company’s five-year Zero Carbon project has surpassed its 2025 target ahead of schedule.

“This is an important step forward in our Scope 3 decarbonization journey and a powerful example of how we can accelerate climate action in our value chain,” she said.