JLL reported $6.5 billion in revenue during the third quarter of 2025, up 10% year over year, with strong growth in project management, workplace management and leasing, according to the company’s Q3 earnings report, released Wednesday.

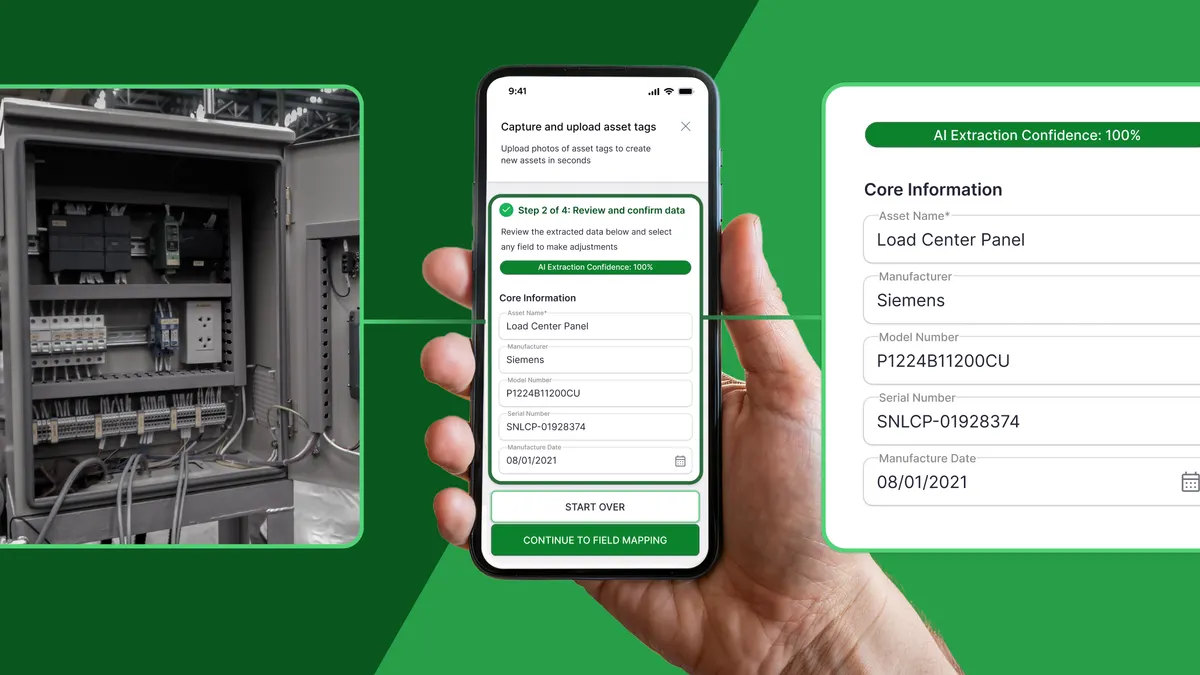

The firm continues to focus on implementing AI within its own organization and the solutions it offers clients, building agentic AI capabilities into its products to address complex needs, JLL CEO Christian Ulbrich said on Nov. 5 earnings call.

“We are scaling rapidly across both adoption and frequency of use,” said Ulbrich, noting that more than 41% of its addressable population is now using proprietary AI tools daily, up from 35% weekly adoption earlier this year.

“We would not have been able to achieve these milestones if not for the combination of our people, global footprint and culture of our broader technology suite, the direct revenue generating software products and our technology solutions business,” he added.

The company’s technology business, which includes software solutions, grew revenue 3% year over year to $172 million.

“The segment allowed JLL to incubate a portfolio of revenue-generating products, including Corrigo and Building Engines, to … service clients in our real estate management services business,” Ulbrich said.

Starting Jan. 1, the company will move its software and technology solutions business into its real estate management services segment, which includes workplace management, project management, property management and portfolio services.

“The main benefit is around efficient gains,” Ulbrich said. “We are … going thoroughly through all our processes within the organization and defining those processes and, if possible, moving those processes to one of our shared service centers. Within the shared service centers, within a couple months, [we] are trying to replace some of that by using AI tools in order to take efficiencies up. That is within our support services, but it is also within our business lines.”

Resilient revenues — stemming from workplace management; project management and property management; value and risk advisory; loan servicing; and software and tech solutions — grew 9% year over year. Transactional revenues, including leasing advisory and investment, were up 13% during that time.

Workplace management revenue increased nearly 30% for the quarter, consistent with the prior four quarters, reflecting the significant market opportunity of new and expanded existing contracts, largely in the U.S., CFO Kelly Howe said on the earnings call.

The company expects elevated contract turnover moving forward as it takes actions to offload contracts that are not effectively contributing to margin expansion, Ulbrich added.

JLL expects its facilities management business to provide continued growth over the medium- and long-term, said Howe, reiterating that the company is “taking a hard look at a set of contracts and intentionally making choices in order to drive margin.”

“We are evaluating all the different country businesses and the profitability of those businesses,” Ulbrich said. “We are getting out of some of those contracts, most notably in Asia-Pacific. So when you look at the overall growth ratio, it is muted, but there are still areas, especially here in the U.S., where we still show nice single-digit-growth in that business.”

Within project management, client activity remains healthy, “positioning us for continued momentum in the fourth quarter,” Howe said.

Office leasing demand remained resilient, with North America up 11% year over year, according to JLL’s earnings presentation. U.S. office demand strengthened during the quarter, “supported by an uptick in large transactions,” as office attendance mandates created space pressures for companies, JLL said.

“On a two-year stack basis, leasing revenue grew nearly 30%. Growth was broad-based across major asset classes, led by office, with continued momentum in the U.S.,” Howe said.

The firm noted that global vacancy rates have declined for the first time since 2019, falling 10 basis points to 16.9% in the third quarter, compared with 17% in Q2. Vacancy is expected to continue to decline due to supply shortages in high-quality buildings and reduced downsizing in the U.S., according to the company’s presentation. The data tracks findings from a Q3 office market dynamics report the company released in October.

“Diminished volumes of large leases continue to be one of the most significant drivers of the gap between leasing over the past year and pre-pandemic norms,” JLL said in that report, noting that large leases over the past year only reflect about two-thirds of pre-pandemic volume.

Industrial leasing revenue grew 6% globally, driven by continued strength in the U.S., which grew 9% year over year, Howe said on the earnings call. The firm sees a healthy leasing pipeline moving forward with client demand for high-quality assets and business confidence remaining resilient over the past year in the face of a “dynamic macro backdrop, providing reason for cautious optimism for continued growth in the near term,” Howe said.

Looking ahead, Ulbrich said the firm's headcount is growing, driven by employees working on-site for JLL’s clients.

“We also have a very strong growth of head count within our shared service centers, because the more you are able to define processes, you are able to move them into ‘Centers of Excellence,’” he said. “Where we see a more flattish development around head count is in our front offices, because the people working in those front offices are so strongly supported by the technology [that] we are offering that they are all becoming significantly more productive in what they are doing.”