In the face of aging infrastructure, rising electricity prices and capital costs, energy savings contracts are no longer optional. By combining on-site renewables, real-time monitoring and performance guarantees, facility managers can implement upgrades and achieve up to 60% savings — without any capital expenditure, according to one company providing these financing contracts.

Given increased demand for electricity and higher transmission, transportation and commodity costs, energy is becoming more expensive, said Patrick Towbin, chief of engineering and construction at Ecosave, an energy service company.

His company combines financing with energy conservation measures, renewable energy infrastructure and smart building controls to convert large capital costs into fixed operating expenses, and adding an energy savings guarantee to the mix.

The company’s contracts— like those of other companies— are gaining popularity among public municipalities and private companies, reports show, as they look to save energy through HVAC and other building system retrofits.

“Federal programs come and go, but the core of our business is saving energy, because energy is costing more and we can do things more efficiently,” Towbin said in an interview. “There is a short-term view that the administration we have now has taken out some of the incentives, but they’ve definitively given a guaranteed runway of two years, which has actually increased the speed of a lot of these projects to actually close.”

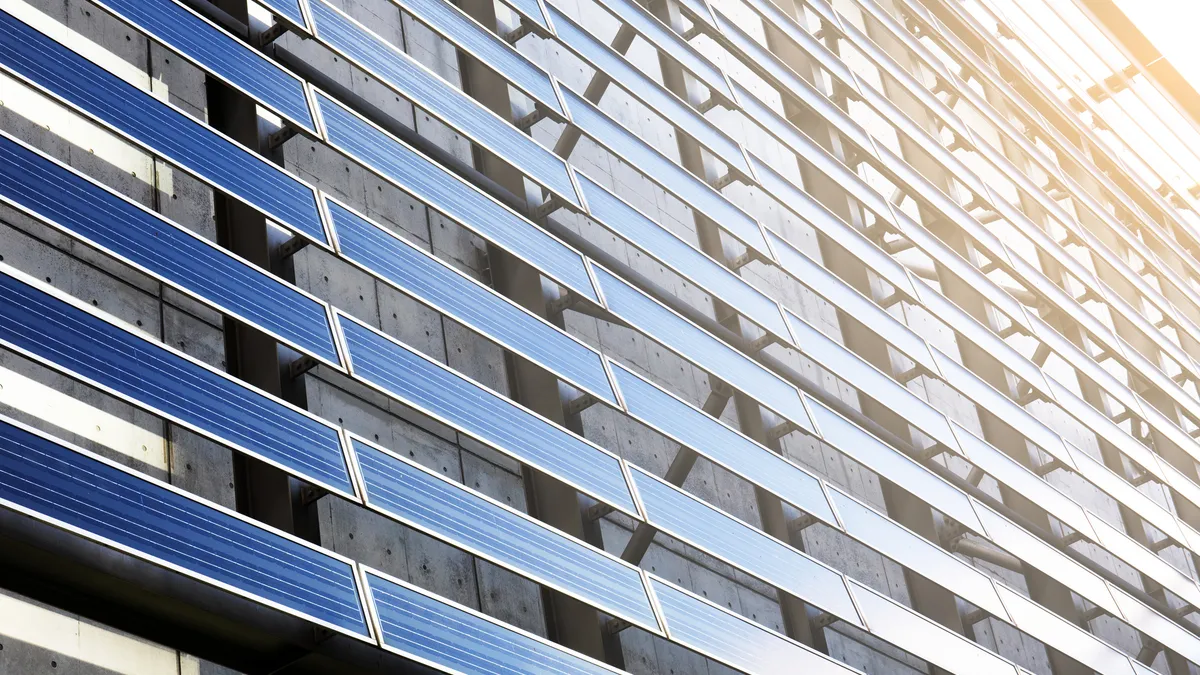

A trend triggered in part by the administration is that solar implementation is becoming more nuanced, he said. “People say [wind and solar] is price competitive, but only because it’s subsidized so heavily by utilities. And now that the subsidy is coming out, we’re looking at the true parity costs,” he said. “The industry has gotten smarter when they apply solar. If you’re in a place that has high power costs and you have sunshine a lot of the time, it makes sense to install it.”

Like solar implementation, many energy savings decisions come down to data. To capture this data and help inform decision making, Ecosave offers smart building automation systems and a proprietary emissions monitoring software to track building efficiency and energy savings.

For example, Ecosave can plug into a commercial building and see that its outside air dampers are broken, resulting in wasted energy savings opportunities.

“You take outside air at 62 degrees, and it helps cool the inside of the building without going through any kind of cooling coils. But because that damper is broken, you can’t do that, so you’re wasting $1,617 every month,” he said. “So, we literally send them an order and say you can fix it, or we can fix it, and it will save you x amount of money and x amount of energy, because we have that kind of data to give them.”

Energy resilience concerns, driven in part by rising costs and increasing uncertainty over reliability, is also driving demand for upgrades, according to Towbin.

“What you’re seeing right now is that utilities are becoming less and less reliable, having more and more interruptions, low-voltage events, et cetera,” he said. “So what [companies] are doing is installing their own generation. They’re using all of the heat, and so … energy efficiency has gone up significantly with co-generation and even combined cycle generating plants that are local.”

Cogeneration, or combined heat and power (CHP), is a type of distributed generation, which unlike central station generation is located at or near the point of consumption. By generating electricity or power at the point of use, the technology allows heat that would normally be lost in the process to be recovered to provide heating or cooling, according to the U.S. Department of Energy.

“CHP applications can operate at about 75% efficiency, a significant improvement over the national average of about 50% for these services when provided separately,” DOE says.

Through the company’s long-term contracts, which typically span between nine and 20 years, Ecosave owns the assets and takes responsibility for insurance. At the end of the contract, customers have the option to purchase equipment for fair market value.

“It’s at the cost of the life of it, so it can be very low,” he said. “The idea is that the value of the equipment, which is still very good equipment at the end of the life of this contract, is basically assumed for a very low cost by the customer. Then they own it and have the option for us to go into a service contract, or someone else can still maintain it if they choose.”