Although many commercial real estate teams lean on technology for facility operations, many are either unsure how to use or are not unauthorized to use artificial intelligence, according to a report by CBRE. As the market for space management tools continues to diversify and evolve, facility leaders should adopt and leverage innovative technologies to optimize space management strategies and improve tech maturity, the firm says.

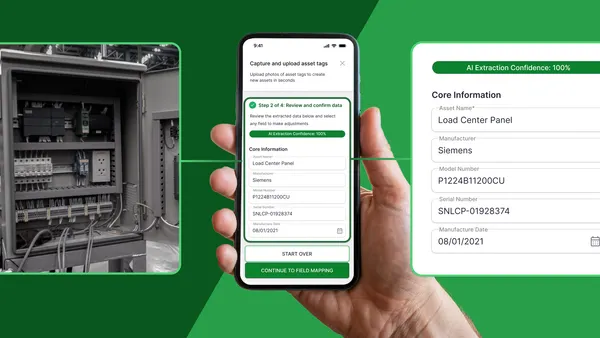

Advanced space management systems that incorporate AI and machine learning can forecast future space needs based on historical occupancy data, helping commercial real estate teams to be more agile in allocating resources and managing their physical environments, according to CBRE. These systems also offer features such as real-time monitoring, automated reporting and personalized workspace environments that cater to individual employee preferences, CBRE says.

Some 90% of teams surveyed use existing software systems — including computer-aided facility management, or CAFM, and integrated workplace management systems, or IWMS — for space data management, asset tracking, occupancy planning and facility operations, making these tools central tools in modern commercial real estate management, per the report.

Still, over a third of respondents said they do not know how AI is being used in their workplace and occupancy management. Over a quarter said they are not authorized to use AI, “reflecting the challenges and opportunities in AI adoption,” CBRE says.

Over 65% identified improvements to workplace experience as a significant goal in their commercial real estate strategy, led by an understanding that employee engagement and well-being are directly linked to productivity and overall business performance, the report says.

“In general, there's a lot more interest and understanding just how the human shows up in a workspace … ‘Why are we making the choices we are? And what are the other space types that might be serving those same activities?’,” Izzy Cannell, workplace insights and advisory lead at VergeSense, told Facilities Dive. “Do we even have them available in the office? That's the other piece. You can't measure something that you don't even have. So starting to bring in the qualitative side to the quantitative data points is really helping tell that full story of preference.”

Hybrid work requires a strategic approach to space utilization, however, prompting organizations to leverage data analytics and AI to monitor real-time occupancy trends, per the report. As operators look to use this technology to optimize office space, consolidate underused areas and enhance operational efficiency, “the data’s maturity will significantly influence outputs and the functions it can support,” CBRE says.

The maturity curve of data utilization, which forms the basis of occupancy management, according to CBRE, indicates a shift in the market from basic data collection to advanced analytics, the firm says. While 77% of organizations responding to CBRE’s 2024-2025 Global Workplace & Occupancy Insights report reported some level of technology maturity, “none have achieved the highest level … indicating significant growth potential,” the firm says.

A slight decline in the IWMS market share suggests growing diversification in the space management technology market as organizations look for alternative platforms that can provide enhanced functionality, per the report.

Space-reservation systems, in particular, have become a critical tool in enhancing the hybrid work experience by providing transparency and predictability regarding when and where employees will be in the office, per the report. The adoption of these systems has grown significantly, with 46% now indicating the use of space-reservation systems, more than doubling in adoption with a 24-percent-point increase year-over-year, according to CBRE.

“This growth reflects the increasing demand for tools that help manage the complexities of hybrid work schedules, where employees may come to the office only on certain days or for specific tasks,” the firm says.